Working Capital Loan Waiver Is Not Taxable As ‘Perquisite’ U/s. 28(iv) Of Income Tax Act: Reiterates Karnataka HC

While setting aside ITAT’s order wherein it was held that benefit upon waiver of working capital loan is perquisite in terms of Section 28(iv) or liable to be assessed under Section 41(1) of the Income tax Act, 1961, the Karnataka High Court held that the benefit from working capital loan waiver was in the form of a cash receipt and did not satisfy the test laid down by Apex Court in case of CIT vs. Mahindra & Mahindra [(2018) 404 ITR 0001 SC] to make it taxable within the terms of Section 28(iv).

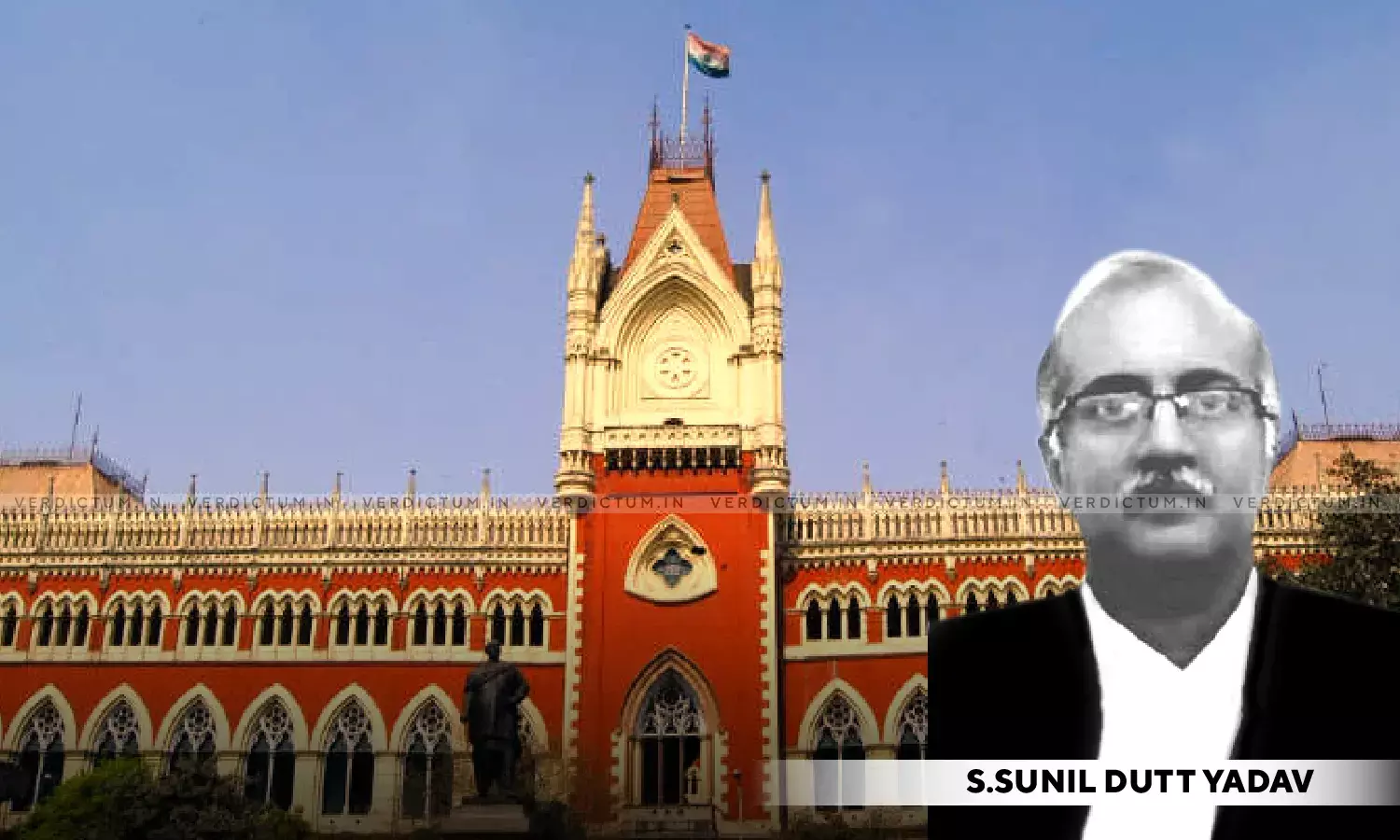

Referring to the decision of Mahindra & Mahindra, a Single Judge Bench of Justice S. Sunil Dutt Yadav observed that the nature of loan would be of no relevance even if the benefit of loan waiver was in the form of a cash receipt, and the only determinative test is that the benefit or perquisite should be other than ‘in the shape of money’.

Senior Advocate S. Ganesh appeared for the Assessee while Revenue was represented by Advocate E.I. Sanmathi.

The brief facts of the case were that during the Assessment year 2006-07, the Assessee-Company entered into an One Time Settlement (OTS) with the bank for term loans and working capital loans whereby portion of interest charged by bank as well as principal amount was waived off. The Assessee offered the waiver of interest amount to tax, however, treated waiver of principal amount as capital receipt, consequently, did not offer the same to tax. The AO treated waiver of principal amount of term loan as well as working capital loan as perquisite in terms of Section 28(iv). On appeal, the ITAT held that waiver of term loan taken for purpose of capital asset would not result in any benefit/perquisite, accordingly, cannot be taxed as revenue receipt, however, waiver of working capital loan would result in flow back of funds to the Assessee which was revenue receipt and liable to tax under Section 28(iv).

After considering the submission, the Bench rejected the Revenue’s contention on maintainability of writ petition and observes that Assessee raised legal question which is covered by Apex Court ruling in Mahindra & Mahindra which lays down a pure principle in law and does not require detailed investigation into facts, accordingly, no purpose would be served in relegating the Assessee to avail the statutory remedy.

On the issue of taxability of waiver of loan, the Bench observed that the only test to determine taxability of benefit or perquisite under Section 28(iv) is that such benefit or perquisite should be other than in the shape of money, and accordingly, the exercise of ascertaining the purpose/nature of loan would be of no relevance.

The Bench also clarified that law laid down by Apex Court in Mahindra and Mahindra still holds the field and the benefit of waiver of loan in the present case is also no other than in shape of money, and accordingly, the benefit would fall outside the ambit of Section 28(iv).

Accordingly, the High Court while pointing that the amendment of Section 28(iv) by Finance Act, 2023, wherein the benefit in form of cash arising from business was also made taxable, sets aside the ITAT’s order.

Cause Title: IG Petrochemicals v. ITAT and Ors.

Click here to read/ download the Order