Notice Issued U/S 148 Income Tax Act Must Comply With Requirements Of Faceless Scheme Even If Taxpayer Is NRI: Telangana HC

The Telangana High Court has held that a notice issued under Section 148 of the Income Tax Act, 1961 (‘Act’) must comply with the requirement of the Scheme made by the Central Government whether or not the Taxpayer is an NRI/Indian Citizen.

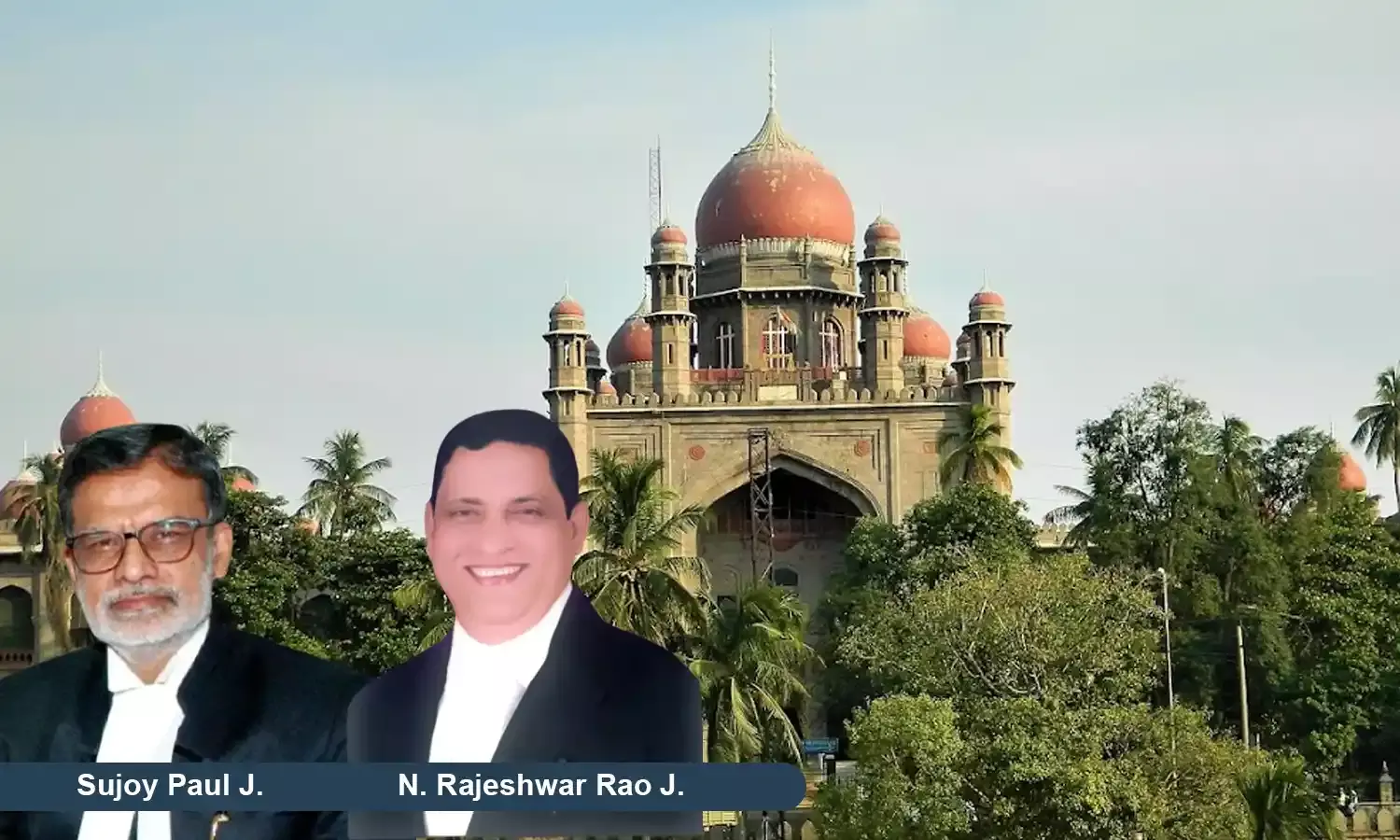

The Division Bench of Justice Sujoy Paul and Justice Namavarapu Rajeshwar Rao held, “Thus, there is no cavil of doubt that Section 144B of the Act and order of CBDT dated 06.09.2021 give exemption from following the mandatory faceless procedure only in relation to passing of assessment orders in cases of central charges and international tax charges. Any other interpretation would amount to doing violence with the language employed in the scheme/notification dated 29.03.2022, Section 144B(2) of the Act and order dated 06.09.2021. Since in our view, the plain and unambiguous language used in the scheme and order dated 06.09.2021 shows that the notice under Section 148 does not fall within the ‘exception’, the judgments cited by the learned Senior Standing Counsel for Income Tax Department are of no assistance. The Taxpayer is nowhere distinguished between NRIs and Indian Citizens. The notice issued under Section 148 must comply with the requirement of the Scheme whether or not the Taxpayer is NRI/Indian Citizen.”

Advocates Dundu Manmohan, A.V. Raghu Ram and A.V.A. Siva Kartikeya appeared for the Petitioners while Senior Standing Counsel Vijhay K Punna appeared for the Respondents.

Various writ petitions were filed under Article 226 of the Constitution which raised the question of whether show cause notices issued under Section 148 of the Act in matters relating to international tax charges are exempted from following the statutory faceless procedure.

The bone contention of the petitioners was that the notices under Section 148 of the Act were issued in utter violation of the prescribed procedure of faceless assessment.

The Court, while referring to Section 151A of the Act, said that the Section is an enabling provision which permits the Central Government to make a scheme for the following purposes: (i) Assessment, reassessment or computation under

Section 147; (ii) Issuance of notice under Section 148; (iii) Conducting enquiries or issuance of notice under Section 148A; and (iv) Sanction for issue of such notice under Section 151. The Court said that the Central Government was competent to make changes but no such directions could be issued after March 31, 2022, but in the exercise of power under Section 151A, the notification dated September 23, 2022, was issued.

The Court observed, “Sub-section (2) of Section 144B of the Act is also an enabling provision to the extent it gives authority to the Board to ‘specify’ about applicability of faceless assessment in respect of class, income, group, etc. Clause 3(b) of notification/scheme dated 29.03.2022 shows that issuance of notice under Section 148 is squarely covered and mandated under clause 3 by making it clear that it shall be through automated allocation, in accordance with risk management strategy formulated by the Board as referred to in Section 148 of the Act for issuance of notice, and same has to be in a faceless manner. The parties are at loggerheads because of expression i.e., “to the extent provided in Section 144B of the Act” used in clause 3(b) of the notification dated 29.03.2022.”

The Court held that the respondents erred in not following the mandatory faceless procedure as prescribed in the scheme and since the notices under Section 148 of the Act were not issued in a faceless manner, the entire further proceeding founded upon it and assessment orders stand vitiated.

“In interpreting a section in a taxing statute, according to LORD SIMONDS, “the question is not at what transaction the section is according to some alleged general purpose aimed, but what transaction its language according to its natural meaning fairly and squarely hits (see St. Aubyn (LM) v. A.G.5). LORD SIMONDS call this “the one and only proper test”. This principle is followed by the Indian Supreme Court in catena of judgments. Thus, in our view, no such exemption from faceless procedure can be read by combined reading of aforesaid provisions for the purpose of issuance of notice under Section 148 of the Act.”, the Court observed.

Accordingly, the Court set aside all the impugned notices under Section 148 of the Act and consequential assessment orders.

Cause Title: Sri Venkataramana Reddy Patloola v. Deputy Commissioner of Income Tax, Circle 1(1), Hyderabad and Ors.

Appearances:

Petitioner: Advocates Dundu Manmohan, A.V. Raghu Ram and A.V.A. Siva Kartikeya.

Respondents: Senior Standing Counsel Vijhay K Punna