MV Act– Driving Vehicle Without Effective License Is Not Just Violation Of Insurance Policy Condition But Also Statutory Violation: Madras HC

The Madras High Court ruled that Section 5 of the Motor Vehicles Act, 1988 mandates the owner of the vehicle to not permit any person who did not have a driving license to drive the vehicle.

In short, the High Court clarified that driving a vehicle despite non-holding of an effective driving license was not just a violation of the insurance policy condition, it was a statutory violation as well.

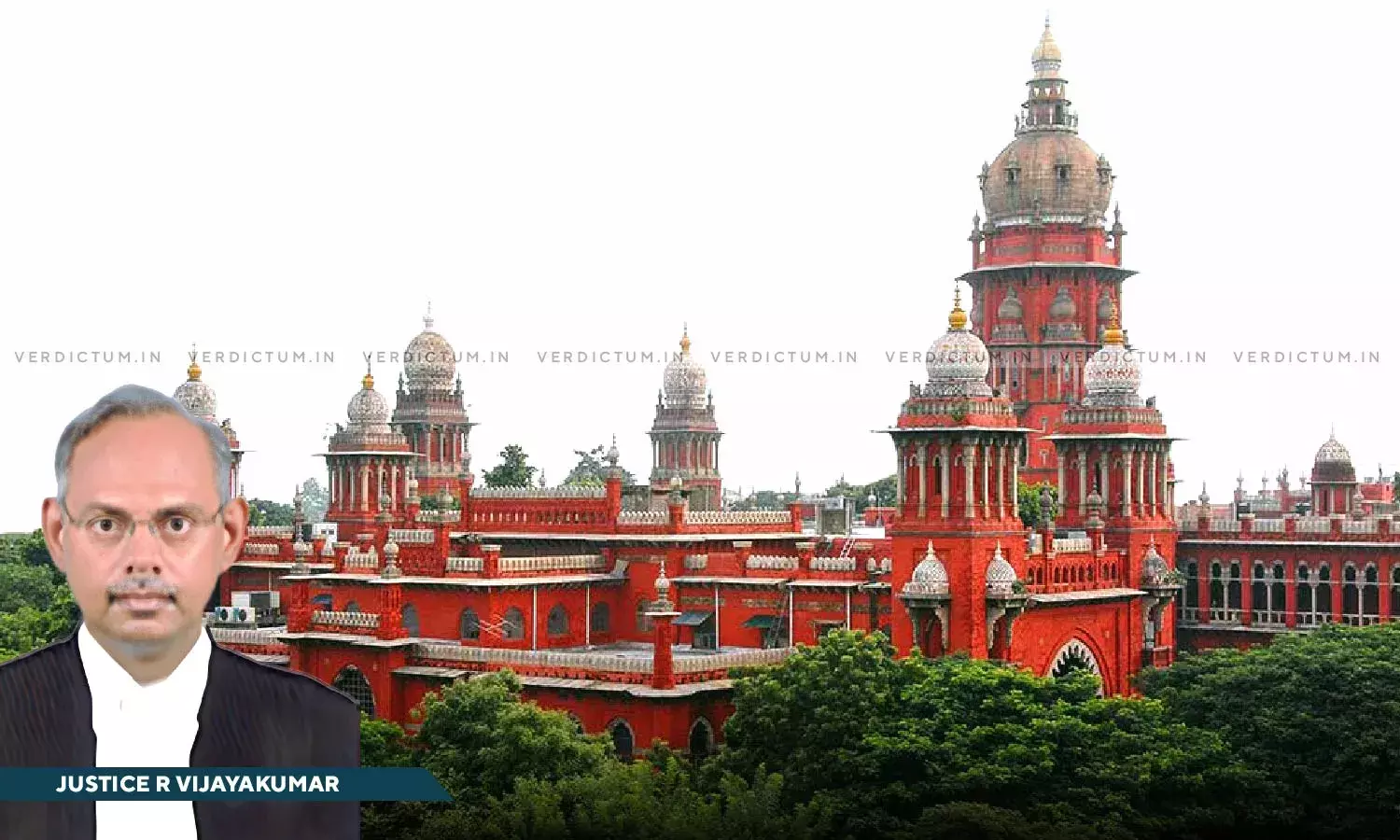

The Single Judge Bench of Justice R. Vijayakumar observed that “When the insurance company has alleged statutory violation on the part of the owner of the tipper lorry, the burden is upon the owner of the tipper lorry to establish that his driver was having a valid and effective driving license at the relevant point of time”.

The Bench thereby stated that the insurance company would first satisfy the award and thereafter could recover the same from the owner of the offending vehicle and accordingly, the quantum, apportionment, and interest awarded by the MACT was confirmed.

Advocate A. Ilango appeared for the Appellant, whereas Advocate D. Gnanasekaran appeared for the Respondent.

Going by the background of the case, the Insurance Company challenged the award passed by the Motor Accident Claims Tribunal (MACT) primarily on the ground of liability. The injured claimant had contended that while he was driving a two-wheeler, a tipper lorry belonging to the first Respondent which was insured with the second Respondent came from the opposite direction in a rash and negligent manner and dashed right against his two-wheeler. The claimant had sustained grievous injuries and hence, had prayed for a sum of Rs.30,00,000/- towards compensation. The owner of the offending vehicle had remained ex-parte and the insurance company had filed a counter contending that the driver of the lorry was not having a badge to drive the heavy vehicle at the relevant point of time. They further questioned the manner of the accident and the quantum of compensation as prayed for. The MACT arrived at a finding that the accident had taken place only due to the rash and negligent driving on the part of the driver of the first Respondent, and hence fixed the compensation at Rs.3,74,520/- and directed the insurance company to satisfy the award. Hence, the present Appellant approached the High Court challenging the award passed by the MACT.

After considering the submission, the Bench stated that the offending vehicle was a tipper lorry which was classified as a heavy vehicle and it required transport endorsement for driving the said vehicle.

The Bench further noted that the driver was not holding a transport endorsement at the time of the accident, and thus, there was a violation of policy condition warranting invocation of the principle of pay and recovery.

Considering the submission of the Respondent that unless the insurance company established that there was negligence on the part of the owner in handing the vehicle to such a person was not having a valid driving license, the principle of pay and recovery could not be invoked, the Bench highlighted that the insurance company had discharged their burden by establishing the fact that the driver of the offending vehicle was not having an effective driving license at the time of the accident.

The High Court also clarified that when the insurance company had alleged statutory violation on the part of the owner of the tipper lorry, the burden was upon the owner of the tipper lorry to establish that his driver was having a valid and effective driving license at the relevant point of time.

Therefore, given the violation of the policy condition and statutory violation, the High Court concluded that the insurance company would first satisfy the award and thereafter, could recover the same from the owner of the tipper lorry.

Cause Title: Branch Manager, National Insurance Company Limited v. Murugan and Anr.

Click here to read/download the Judgment