Classification Of Goods Under Customs Tariff Act, 1975 Shall Be In Accordance With Heading Which Provides More Specific Description- Reiterates SC

The Supreme Court has reiterated that the classification of goods under the Customs Tariff Act, 1975 (CTA) should be in accordance with the heading which provided more specific description than general one.

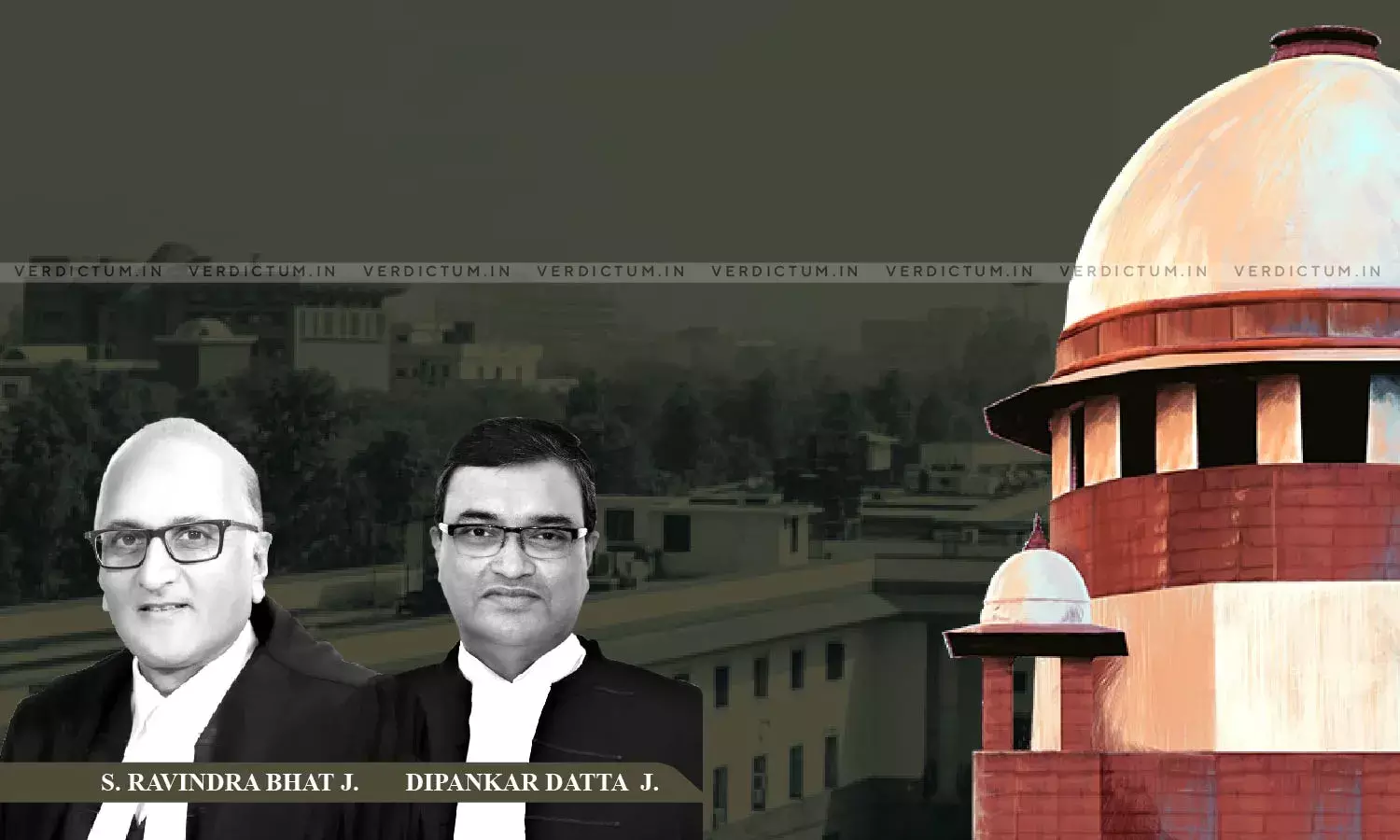

The Bench of Justice S. Ravindra Bhat and Justice Dipankar Datta referring to its decision in the case of Secure Meters v. Commissioner of Customs 2015 (14) SCC 239 observed that “It is, therefore, clear that when goods are excluded from a particular chapter, the “pull in” through a note has to be narrowly construed, as otherwise, the basis of exclusion would be defeated, and the earlier note (of exclusion) rendered redundant. Finally, Secure Meters (supra) is decisive on the question that LCDs are not articles provided “more specifically in other headings”, i.e., other than 90.13. Furthermore, the fact that LCDs could be used for purposes other than television sets or audio sets is also concluded”

Advocate Nisha Bagchi appeared for the appellant- revenue and Senior Advocate Vivek Singh appeared for the respondent- M/s Videocon International (Videocon) and Advocate V. Lakshmikumaran appeared for the respondent- M/S Harman International (India) Pvt. Ltd. (Harman).

The appeals were preferred against the two orders of the Customs, Excise and Service Tax Appellate Tribunal (CESTAT). In the First Appeal- CESTAT had allowed Videocon’s appeal and had held that the LCD panels imported by it were classifiable in Chapter Heading (“CH”) 9013.8010 of the First Schedule to the Customs Tariff Act, 1975 (CTA) as Liquid Crystal Devices- as opposed to the revenue’s stand, that they were classifiable as 85.29 "parts of goods falling under heading 85.28" I.e. television sets.

In the second appeal- CESTAT held that import of LCD panels by Harman was held to be classifiable under CH 9013.8010, rejecting the revenue’s contention that they were classifiable as “Car Audio or Video Players” under either CTH 8519 or 8555.

It was contended by the revenue that the goods imported were LCD devices, which meant principally to be used in television sets and the same was not specifically classifiable under its heading. Therefore, by virtue of Note 2 (b) to Chapter 85, the goods were to be classified based on their principal or sole use.

The Apex Court on considering the General Interpretive rules and the notes to the concerned chapters 85 and 90, noted that-

- General Note (1) states that classification has to be in consonance with terms and headings in chapter notes.

- Rule 3 (a) categorically enjoins that in regard to classification, the heading providing for a “more” specific description prevails over the general one.

- Note 1 (m) – in Chapter 85 excludes the application of articles falling in Chapter 90.

“...In this court’s opinion, this note, along with the General Note 3 (a) [of the General Rules of Interpretation] that headings that are specifically provided, should be preferred over the general ones, is decisive. Thus, the revenue’s contention that by virtue of Note 2 (b) to Chapter 85, the goods are to be classified based on their principal or sole use is insubstantial because of the clear mandate of Note 1 (m), which excludes Chapter 90 goods (which includes LCD panels).” observed the Apex Court.

Therefore, the Court concluded that “...the CESTAT’s reasoning and conclusions, in both cases, that the LCD sets were under Chapter 90, Entry 9013.8010, is sound and unexceptionable.”

Accordingly, the appeals were dismissed.

Cause Title- CCE, Aurangabad v. M/s Videocon Industries Ltd. Thr. Its Director

Click here to read/download the Judgment