'Since Customs Authorities Wanted To Classify Goods Differently, Burden Of Proof Was On Them': SC While Allowing Appeal Of HP, Lenovo

The Supreme Court has recently allowed two appeals filed by HP India Sales Pvt. Ltd. and Lenovo (India) Pvt. Ltd. respectively against the Commissioner of Customs (Import) relating to the classification of Automatic Data Processing Machines (ADP) popularly known as ‘All-in-One Integrated Desktop Computer’ (goods) under the Central Excise Tariff Act, 1985.

The Court held that since the customs authorities wanted to classify the goods differently, the burden of proof to showcase the same was on them, which they failed to discharge.

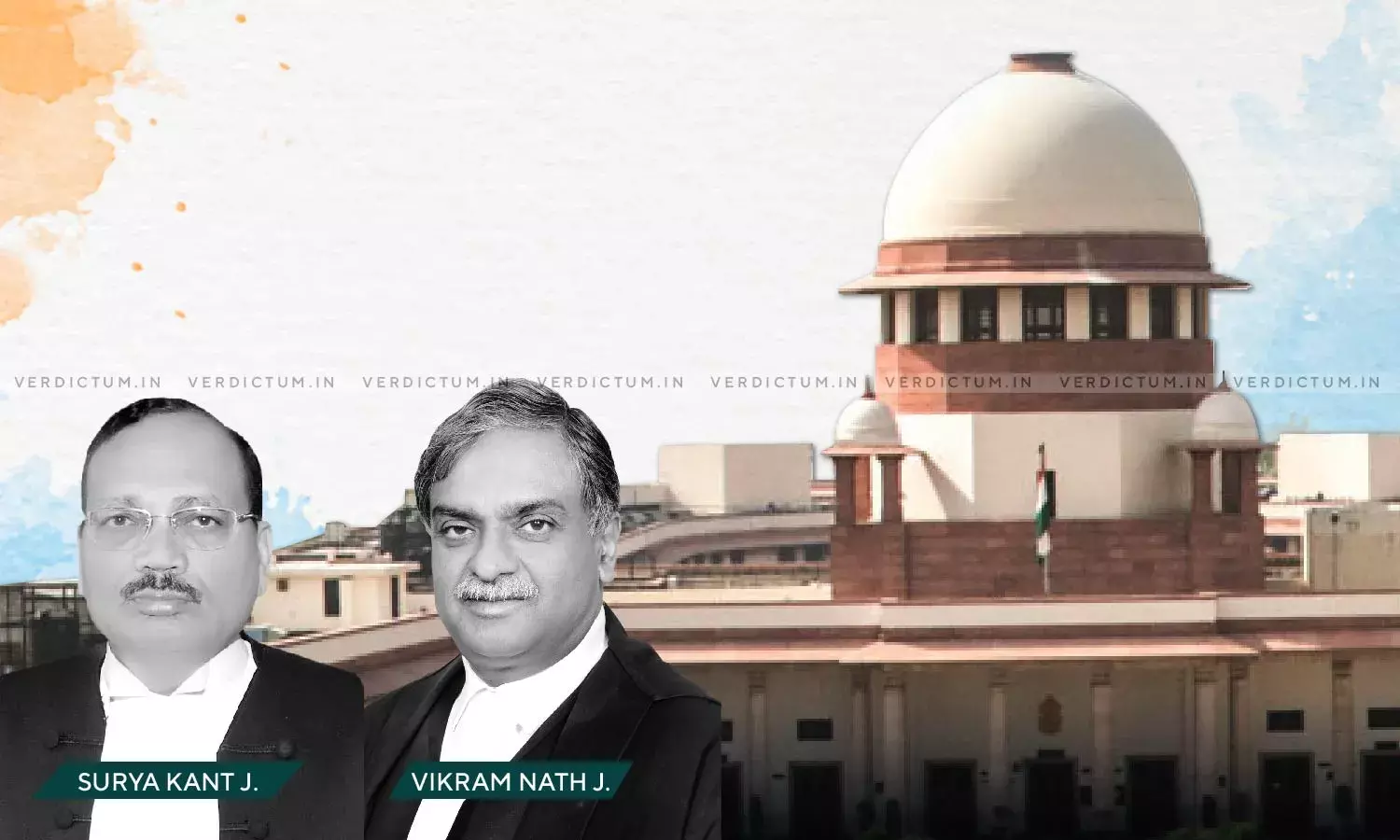

A two-Judge Bench of Justice Surya Kant and Justice Vikram Nath said, “It goes without saying that since the customs authorities wanted to classify the goods differently, the burden of proof to showcase the same was on them, which they failed to discharge. Hence under the prevalent self¬assessment procedure, the classification submitted by the Appellants must be accepted.”

The Bench also observed that scientific progress has greatly reduced the weight associated with high performance in the context of ADPs.

Advocate V Lakshmikumaran appeared on behalf of the appellants while Senior Advocate Arjit Prasad appeared for the respondent.

Brief Facts –

The appellants imported certain units of the concerned goods and classified them under a specific category as per the prevalent self-assessment procedure. During subsequent examination by the Custom Authorities, the concerned goods were classified under ‘the another category, which was later confirmed by the Assistant Commissioner of Customs and Commissioner of Customs (Appeal). Such findings were further affirmed by the Customs, Excise and Service Tax Appellate Tribunal (CESTAT) vide the impugned judgments.

While the rate of duty was same under both the category of Tariff Items, the method of computing them was different. The goods under the former category attracted the application of Section 4A of Central Excise Act, 1944, which valued the excisable goods on the basis of percentage of retail sale price while a classification under the former category invited valuation based on price mechanism under Section 4 of the Act which would have effectively reduced the overall liability to pay the requisite duty. Such a difference in liability was the precise reason behind the dispute.

The High Court after hearing the contentions of both parties asserted, “On a conjoint reading of the relevant material and inputs, it is explicitly clear that weight cannot be the sole factor to determine the factum of portability. Instead, the essential ingredients to logically establish whether an ADP is ‘portable’ are twofold.”

The Court further noted that the advent of LED technology, faster microchips, etc. has made it possible for mobile phones to have performance specifications that merely a decade ago were possible only on high-end laptops.

“Keeping in view the applicable understanding of the element of ‘portable’ as understood in common parlance used in the trade of ADPs, we must hold that the Concerned Goods are not portable for the reasons that¬ Firstly, the diagonal dimension of the Concerned Goods being minimum of the length of 18.5 inches and the same needs to be transported along with the power cable as well as the applicable stand in most cases if it is to be mounted and; secondly there being no protective case designed by the markets for daily transport for these Concerned Goods”, the Court said.

The Court, therefore, held that the concerned goods cannot be carried around easily during the daily transit and hence, the goods are not portable.

Accordingly, the Court allowed the appeals and set aside the orders of CESTAT.

Cause Title- Hewlett Packard India Sales Pvt. Ltd. (Now HP India Sales Pvt. Ltd.) v. Commissioner of Customs (Import), Nhava Sheva

Click here to read/download the Judgment