GST On Mining Royalty: Supreme Court Issues Notice On SLP Challenging Rajasthan HC's Verdict Upholding Notice

The Supreme Court has issued notice on an SLP challenging the Rajasthan High Court's decision dismissing a plea against show cause notices issued in relation to GST on royalty paid to the state government in respect of mining operations.

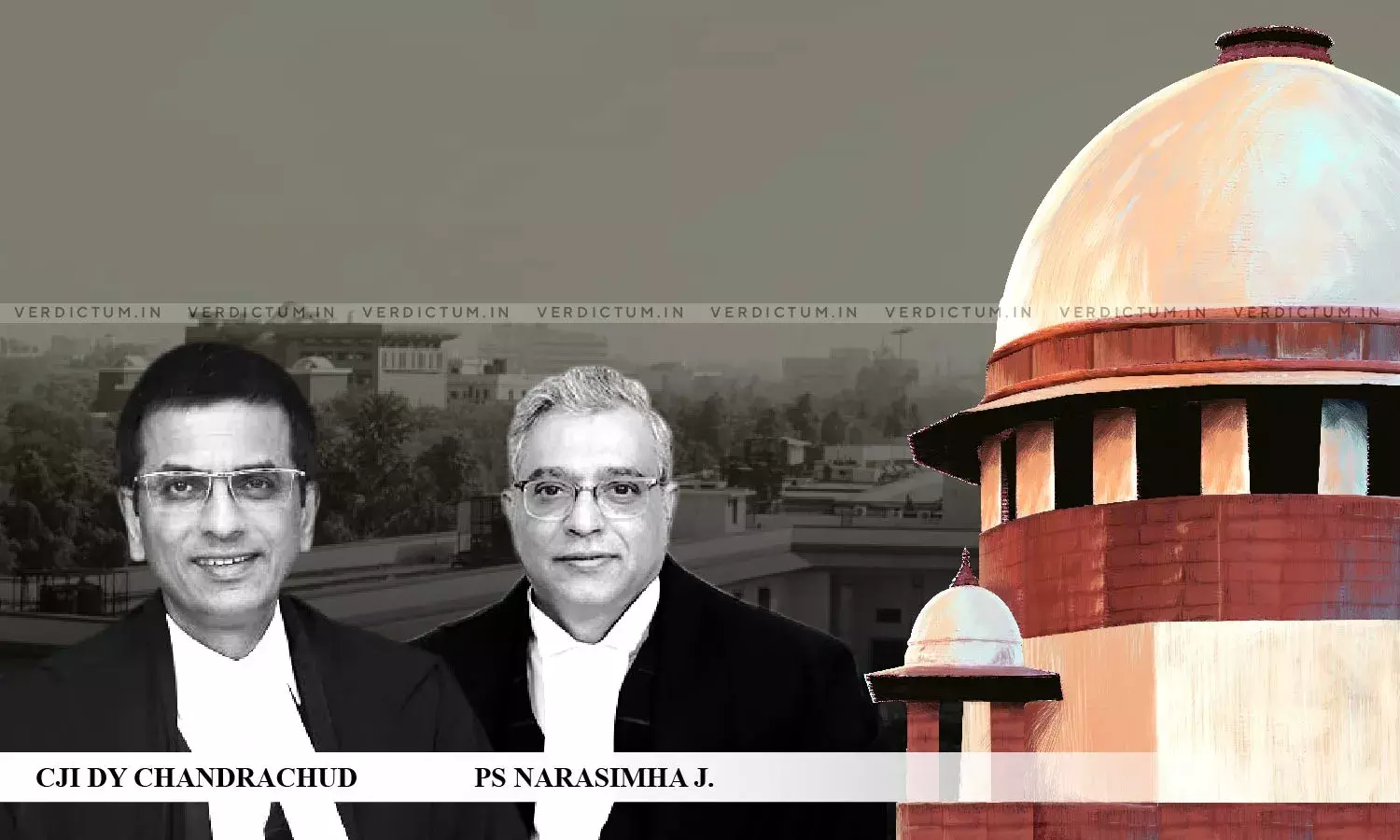

The Bench of Chief Justice D. Y. Chandrachud and Justice P. Narasimha issued notice on the prayer for stay as well as the SLP.

The Petitioner Hanumangarh Int Nirmata Samiti whose members were issued with show cause notices has contended before the Apex Court that the dismissal of its Writ Petition by the High Court has given rise to a nation-wide disparity and inconsistency inasmuch as the manufacturers and traders in other states such as Gujarat, Maharashtra, Karnataka, Uttar Pradesh etc. (where a stay of GST on mining royalty is prevalent till the adjudication of the issue by the Apex Court) are reaping the benefits in their trade and commerce activities related to mining products when transported to other states.

Advocate Kartik Seth appeared for the Petitioner and submitted that the same issue is already subjudice before the Court and that the issue of whether royalty on mining is a tax or not has been referred to a 9-judges bench. He also submitted that 16 High Courts have granted a stay on GST payable on royalty on mining and only the Rajasthan High Court, by the impugned judgment has decided not to grant a similar relief.

As per the Petitioner, under the reverse charge mechanism, business houses have to pay service tax on the amount of mining royalty paid to the Government for carrying out mining and quarrying operations. All the mining companies engaged in mining are required to pay huge royalties (which itself is a tax) to the Government for running quarrying operations despite the fact that royalty is the price of winning minerals from the land and represents the State's share in such minerals and there is no element of provision of any service by the State and that hence the levy of service tax or GST is ultra vires the Act.

The Petitioner has contended that a seven-judge bench of the Court in the case of India Cements and Ors. vs. State of Tamil Nadu and Ors. has already held that mining royalty is a tax. "In terms with the same, the contention of the Petitioner association is that there cannot be an imposition of tax on tax, mining royalty here being already a tax regularly paid by the Petitioner", the SLP says.

"..rendering of a 'service' and existence of a service provider and service recipient relationship between two parties is a sina qua non for payment of service tax. No such relationship however exists between the Petitioner and the State in the present case", the plea says.

Cause Title: Hanumangarh Int Nirmata Samiti v. Union of India & Ors.

Click here to read/download Order