Is The Issuing Bank Exigible To Service Tax On Interchange Fee In A Credit Card Transaction? – Division Bench Of SC Renders Split Verdict

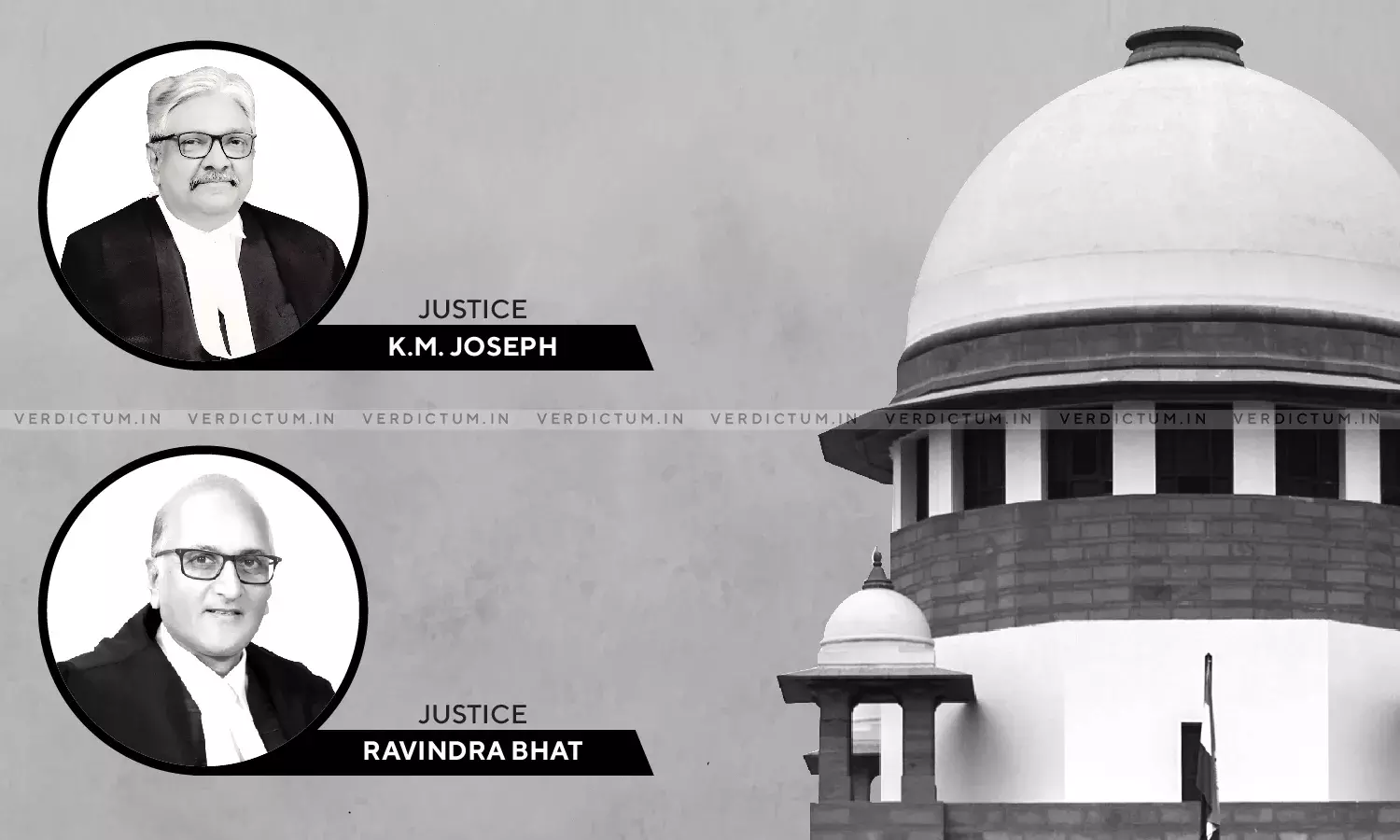

A Division Bench of the Supreme Court comprising of Justice K.M. Joseph and Justice Ravindra Bhat, has rendered a split verdict on the question of law that concerned Citi Bank [hereafter referred to as the "Bank"]. While Justice Joseph allowed the appeals of the revenue and remand the matter back to the Tribunal for consideration of certain issues, Justice Bhat, via a separate and dissenting judgement dismissed the appeals.

Mr. Balbir Singh, Additional Solicitor General appeared on behalf of the appellants while submissions on behalf of the Bank were advanced by Mr. Arvind Datar, Senior Advocate.

The appeals were filed under Section 35L(1)(b) of the Central Excise Act, 1944, read with Section 83 of Chapter V of the Finance Act, 1994 [in short the "Act"]. The appeals were directed against the orders passed by Customs, Excuse and Service Tax Appellate Tribunal, South Zonal Bench, Chennai [in short the "Tribunal"].

The Tribunal had quashed the final orders passed by the Principal Commissioner Service Tax, Chennai [in short "PCIT"], wherein, it was inter alia held that the Bank was liable to pay service tax, penalty and interest on the "interchange fee" which it received. This interchange fee was being charged by the Bank and resulted in being a part of the gross amount which was billed to a customer.

The Bank argued that it is not performing any service which would make it exigible to service tax on the interchange service being offered by it. The Bank contended that the interchange fee is in the nature of interest that it would earn on a credit card transaction initiated by its customer. It was argued that the methodology adopted by the revenue would amount to double taxation as the interchange fee would have already been subjected to service tax, albeit, in the hands of the acquiring bank.

Justice Joseph's analysis:

It was noticed that despite the fact that 'credit card service' was omitted from the definition of Section 65(12) of the Act, Section 65(105)(zzzw) refers to any service provided or to be provided to any person by any other person, in relation to credit card, debit card, charge card or any other payment card service, in any manner, as a 'taxable service'.

The learned judge discussed the nature of a credit card transaction. The learned judge observed that the legislature knows as to how complex economic transactions are playing out on the ground and hence, after deducing as to what a credit card transaction entails - the legislature has framed Section 65(33a) of the Act in a manner which would give meaning to different players involved in such a transaction.

On the question as to whether a service was provided by the Bank in a credit card transaction, the learned judge answered the same in affirmative while holding that such a service is in connection with clause (iii) of Section 65(33a) of the Act.

The learned judge, while dealing with the argument advanced on behalf of the Bank that the interchange fee is in form of an interest and not service, made the following observations.

"It is inconceivable that there is a creditor and debtor relationship between the respondent as issuing bank and the Card Association or the acquiring bank or even the merchant establishment. The respondent cannot be described as a lender of money and the other three players, as just hereinbefore described, as borrowers. In the context of the relationship of the respondent as issuing bank, interchange fee cannot be described as compensation fixed by the parties for use or forbearance of the borrowed money. In fact, the concept of borrowed money, is predicated on the existence of creditor-debtor relationship which is absent. Interest, in the context of the definition, in Law Lexicon by Ramanathan Iyer, places a time value on the funds or money involved and further, it would also involve the rate, at which, the interest is calculated. Again, this definition is apposite in the context of the relationship between a lender and a borrower. The nature of the service, I have unravelled, performed by the issuing bank includes the act of approval of the credit card transactions. It is an integral and indispensable part of a credit card transactions. It was partly for this service that the interchange fee is earned by the respondent as issuing bank. There is no scope for an implied contract as the interchange fee is apparently paid in terms of the contract. Quite clearly, there is no scope for applying equity as the basis for the interchange fee as interchange fee is payable under the contract and towards service rendered by the respondent. I am, in the circumstances, of the view that the contention of the respondent is meritless."

The learned judge also dealt with the argument that the transaction in issue is in money and therefore, it ought to be excluded from the definition of the word service. It was held that there is clearly an activity in relation to the use of money within the Explanation of the concerned provision. The learned judge proceeded to allow the appeals and remanded the matter back to the Tribunal.

Justice Bhat's analysis:

Justice Bhat rendered a separate and dissenting opinion. The learned Judge discussed the scheme of the Act as also the history of the concerned provisions and culled out the issue for consideration as follows.

"The issue which this court has to decide is whether the service of settlement of an "amount transacted", on behalf of the holder of a credit card – which involves several components, or elements of a unified service, are to be taxed as a whole or, in addition to the taxation of the entire transaction, a separate part of that service, i.e., by the issuing bank, in the form of authorization of credit – to be released to the provider of goods or services – is also separately to be valued and subjected to levy."

The learned judge, then, proceeded to discuss Section 65(33a) and its interpretation. While disagreeing with Justice Joseph's reasoning on this score, Justice Bhat made the following crucial observations.

"Crucially, then, only in Section 65(33a) (iii) does service by any person include service by the issuing bank and the acquiring bank. The use of the conjunctive "and" [in Section 65 (33a) (iii)] is to be contrasted with the other subclauses. Parliament used the disjunctive "or" in all other subclauses. The clear intention for this difference was that service providers could be business entities providing more than one service under one subclause [such as subclauses (ii), (iv), (vi) and (vii)]. The use of the conjunctive "and" in clause (iii) therefore, is telling and consequently, in my opinion should receive literal interpretation. I, therefore, disagree with the judgment of K.M. Joseph, J on this aspect."

Justice Bhat pointed out that there were several problems with segregating the components of service by the issuing bank and that by the acquiring bank under Section 65(33a) (iii) of the Act. Justice Bhat agreed with Justice Joseph that amount received by issuing bank as interchange income is not towards interest, however, he disagreed with the conclusion arrived at by Justice Joseph that the issuing bank provides a 'separate' service.

According to Justice Bhat, "… the service element provided by an issuing bank is an integral part which gets subsumed in the single unified service provided by the acquiring bank to a merchant establishment." Hence, Justice Bhat disagreed with the view taken by Justice Joseph that the Bank had to independently file returns qua the transaction via which interchange fee was collected.

In sum, Justice Bhat held that even though the Bank was providing a service, this service was a part of single unified service provided by both the acquiring and issuing Bank. Justice Bhat held that the question of remand does not arise and hence, he proceeded to dismiss the appeals.

The matter has, thus, been directed to be listed before the Chief Justice of India for constituting an appropriate bench, given the divergence of opinion.

Click here to read/download the Judgment