Larger Bench Decision Will Prevail Over Bench Of Lesser Strength, Irrespective Of Number Of Judges Constituting Majority: SC

The Supreme Court's Constitution Bench has held that the decision of a larger bench will prevail over the decision of a bench of a lesser strength, irrespective of the number of judges constituting the majority.

"In view of Article 145(5) of the Constitution of India concurrence of a majority of the judges at the hearing will be considered as a judgment or opinion of the Court. It is settled that the majority decision of a Bench of larger strength would prevail over the decision of a Bench of lesser strength, irrespective of the number of Judges constituting the majority.", the Bench observed.

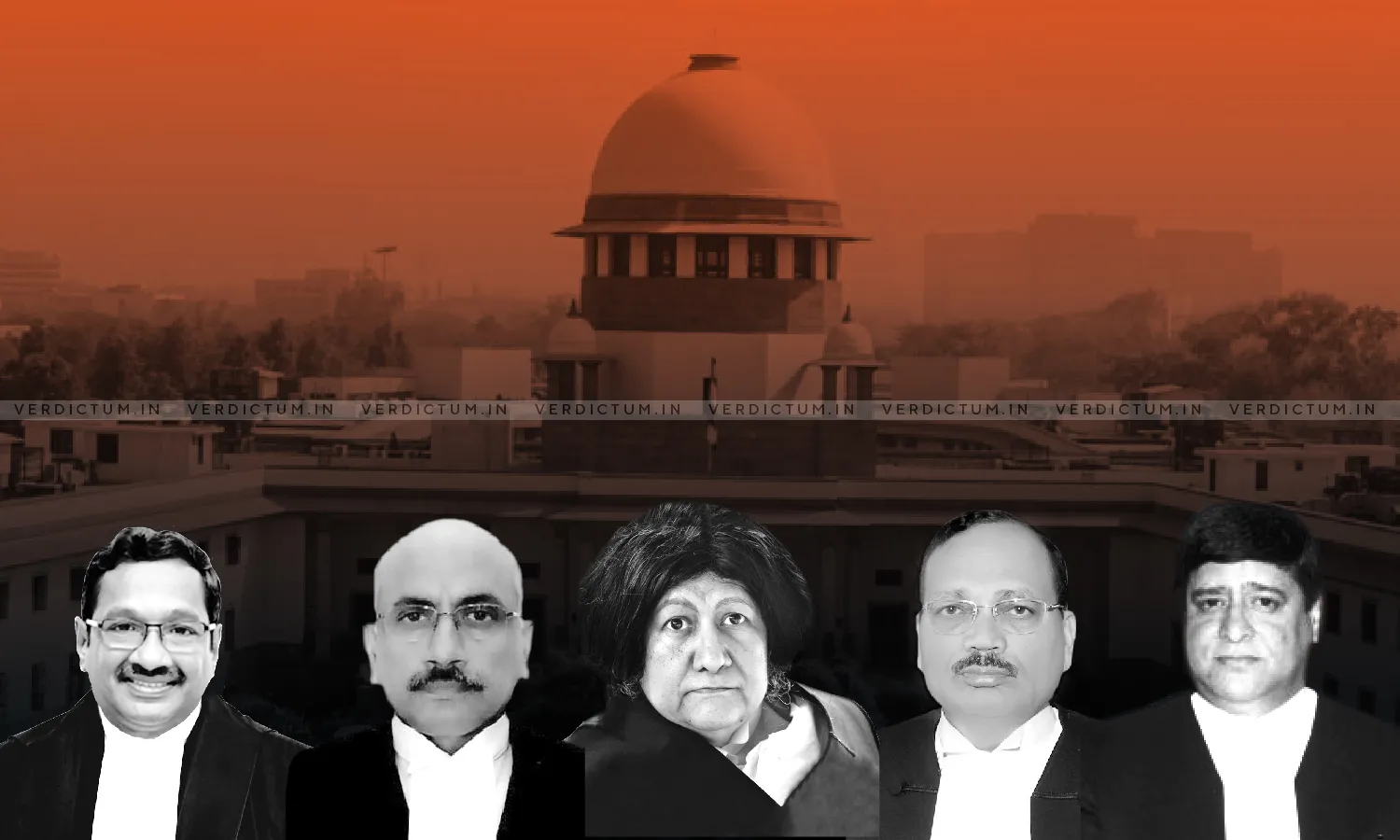

The Bench comprised Justice Indira Banerjee, Justice Surya Kant, Justice MM Sundresh, Justice Sudhanshu Dhulia, and Justice Hemant Gupta.

Advocate Praveen Kumar represented appellant-M/S Trimurthi Fragrances (P) Ltd. whereas Advocate Gurmeet Singh Makker represented Govt. of NCT of Delhi.

A Bench of two Judges had referred to the constitution bench the following questions-

• Whether the Kothari Products Ltd. v. State of A.P. line of judgments or the Central Sales Tax vs. Agra Belting Work, line of judgments is correct in law; and

• What should be the proper guidelines for the future for overruling an earlier decision of this Court, and to what extent should the Courts be guided by the propositions in Ningappa Ramappa Kurbar v. Emperor, the observations of Lokur, J. in Supreme Court Advocates-on-Record Assn. v Union of India and the judgment of the Court of Appeal in Harper v. National Coal Board.

The Constitution Bench noted that there is no conflict between the Kothari Products (supra) line of cases and the Agra Belting line of cases.

The Court observed that the Kothari Products (supra) line of cases was on the question of whether "tobacco" or other goods specified in the First Schedule to the ADE Act and hence exempted from Sales Tax under State sales tax enactments, can be made exigible to tax under the State enactments by amending the Schedule thereto.

On the other hand, Agra Belting Works (supra) line of cases was on the question of interplay between general exemption of specified goods from sales tax under Section 4 of the U.P. Sales Tax Act and specification of rates of sales tax under Section 3A of the said Act. Supreme Court had held that goods exempted from sales tax under Section 4 would be exigible to tax by virtue of subsequent notification under Section 3A specifying the rate of sales tax for any specific item of the class of goods earlier exempted under Section 4.

"There being no conflict, the reference to Constitution Bench is incompetent. The cases may be placed for decision before the regular Bench.", the Bench held.

Cause Title- M/S Trimurthi Fragrances (P) Ltd. v. Government of N.C.T. of Delhi

Click here to read/download the Judgment