Charitable Education Institutions Registered Under Maharashtra Public Trusts Act Are Not Exempted From Payment Of Electricity Duty: Supreme Court

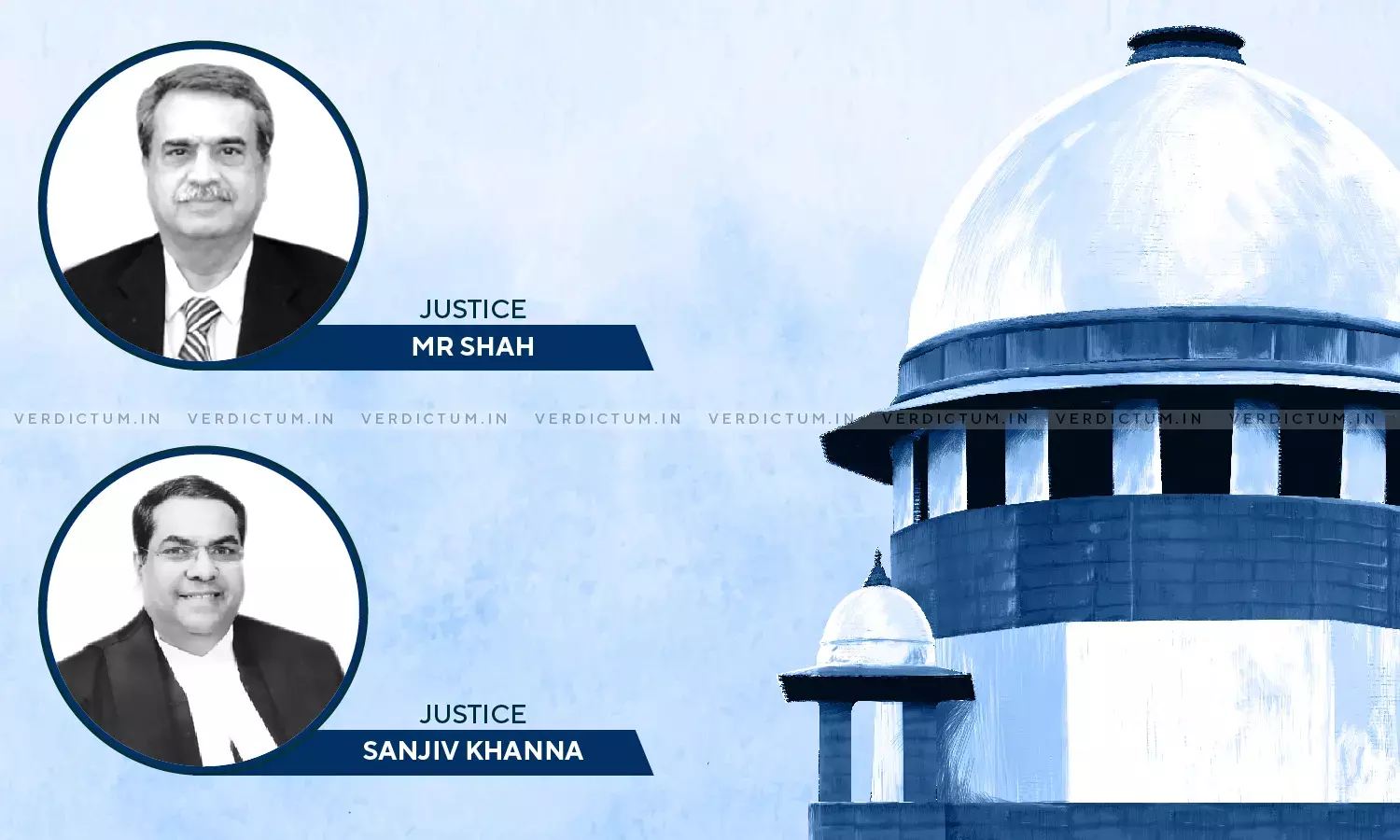

A two-judge Bench of Justice M. R. Shah and Justice Sanjiv Khanna has set aside a judgment passed by the Bombay High Court, by which it was held that the Charitable Education Institutions registered under the provisions of the Societies Registration Act and/or under the Maharashtra Public Trusts Act are exempted from the payment of electricity duty from the date on which the Maharashtra Electricity Duty Act, 2016 came into effect.

Aggrieved by the Judgment of the Bombay High Court, the State of Maharashtra had approached the Supreme Court.

Mr. Sachin Patil appeared for the State-Appellant while Senior Counsel Mr. Shekhar Naphade appeared for the original Writ Petitioners-Respondents before the Supreme Court.

In this case, the Respondents were the education institutions run and managed by Shri Vile Parle Kelvani Mandal, a society registered under the Societies Registration Act, 1860. They had taken electricity connections for supply to their educational institutions. Prior to 01.09.2016, the charitable education institutions were exempted from payment of electricity duty levied on the consumption charges or the energy consumption for the purposes of or in respect of a school or college or institution imparting education or training, students' hostels, hospitals, nursing homes, etc.

In the year 2018, the respective electricity supply companies levied the electricity duty pursuant to a letter from the Industries, Energy and Labour Department, Government of Maharashtra stating that as per Maharashtra Electricity Act, 2016, charitable institutions registered under the Maharashtra Public Trusts Act, 1950 for the purpose of schools or colleges not being entitled to electricity duty exemption with effect from 1st September 2016. Thus, the bills were raised with an electricity duty of 21% being levied.

The issue which was dealt with by the Court was -

Whether the original writ petitioners being charitable education institutions registered under the provisions of the Maharashtra Public Trusts Act, 1950 are entitled to the exemption from payment of electricity duty post 01.09.2016 i.e., as per the provisions of the Maharashtra Electricity Duty Act, 2016.

The Bench held that, "On true interpretation of Section 3(2)(iii), under 2016 Act, electricity duty on the consumption of charges or energy consumed for the purposes of, or in respect of a school or college or institution imparting education or training, student's, hostels………….run by any local bodies shall alone be exempted from levy of electricity duty and the State Government and Central Government are also specifically excluded from payment of electricity duty. However, the public sector undertakings are not exempted from payment of electricity Act. Therefore, under Section 3(2) of the 2016 Act, the charitable institutions running the educational institutions are not exempted from payment of electricity duty, which as such was specifically exempted under Section 3(2)(iiia) of the 1958 Act."

The Court also observed, "The intention of the legislature as per Section 3(2) of the 2016 Act, is very clear and unambiguous that the electricity duty shall not be leviable on the consumption charges or energy consumed (i) by the State Government excluding the public sector undertakings; (ii) by the Central Government excluding public sector undertakings and (iii) ……. run by the local bodies constituted under any law for the time being in force in the State of Maharashtra. Other than the State Government, Central Government and the local bodies and the Government hostels, no exemption from payment of electricity duty has been provided."

Accordingly, the Court allowed the appeal and quashed and set aside the judgment given by the High Court of Bombay and held, "Charitable education institutions registered under the Societies Registration Act and the Maharashtra Public Trusts Act, are not exempt from levy/payment of electricity duty levied on the consumption charges or the energy consumed even with respect to the properties used by such charitable education institutions for the purpose of or in respect of the school/college imparting education or training in academic or technical subjects."