IBC - Holder Of Recovery Certificate Would Be Entitled To Initiate CIRP As Financial Creditor - Supreme Court

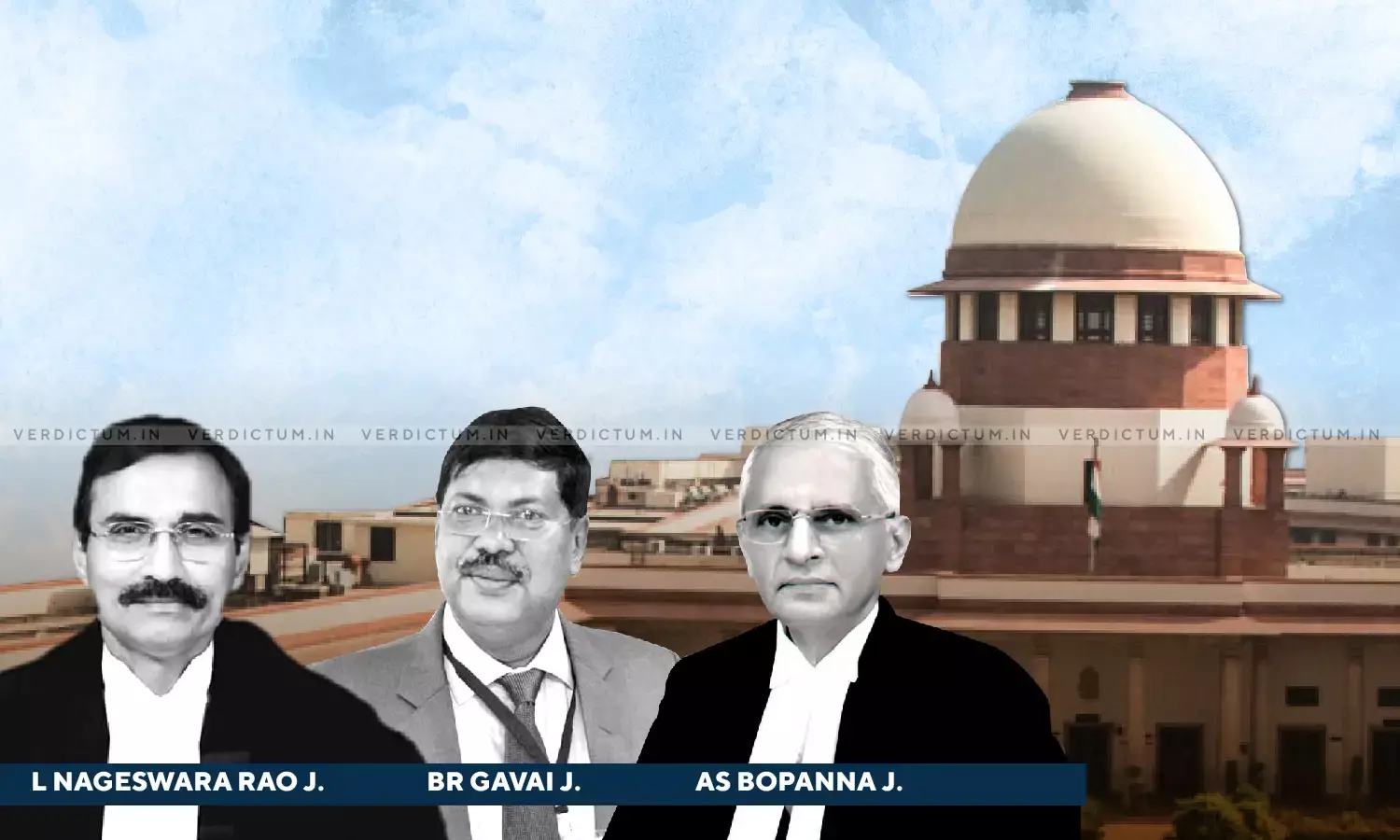

The Supreme Court bench comprising Justice L. Nageswara Rao, Justice B.R. Gavai, and Justice A.S. Bopanna has held that the holder of the recovery certificate would be entitled to initiate the Corporate Insolvency Resolution Process if initiated within a period of three years from the date of issuance of the Recovery Certificate.

In this context, the Bench noted -

"To conclude, we hold that a liability in respect of a claim arising out of a Recovery Certificate would be a "financial debt" within the meaning of clause (8) of Section 5 of the IBC. Consequently, the holder of the Recovery Certificate would be a financial creditor within the meaning of clause (7) of Section 5 of the IBC. As such, the holder of such certificate would be entitled to initiate CIRP, if initiated within a period of three years from the date of issuance of the Recovery Certificate."

The Supreme Court also held that a liability arising out of a Recovery Certificate would be a "financial debt" within the meaning of Section 5(8) of the Insolvency and Bankruptcy Code (IBC) 2016 and a holder of the recovery certificate would be a financial creditor under Section 5(7) of the IBC.

In this case the Ind Bank Housing Limited (IBHL) had sanctioned separate credit facilities to borrowing entities- M/s Green Gardens (P) Ltd, M/s Gemini Arts (P) Ltd., and M/s Mahalakshmi Properties & Investments (P) Ltd. Respondent 2 in the case i.e., M/s Prasad Properties and Investments Pvt. Ltd., stood as the Corporate Guarantor/mortgagor and mortgaged its immovable property by deposit of title deeds to secure the aforesaid credit facilities sanctioned to the borrower entities.

These borrower entities defaulted in repayment of the dues and IBHL filed three civil suits before the Madras High Court against the borrower entities and the Corporate Debtor, for recovery of the amounts due.

Meanwhile, the appellant in the present case– Kotak Mahindra Bank Ltd. (KMBL) and IBHL entered into a Deed of Assignment dated 13th October 2006, wherein IBHL assigned all its rights, title, interest, estate, claim and demand to the debts due from borrower entities, to KMBL.

Pursuant to the said deed, KMBL and the borrower entities entered into a compromise on 7th August 2006 which was recorded by the High Court to the effect that the Corporate Debtor was jointly and severally liable to pay the amount of Rs. 29,00,96,918/ due from the borrower entities to KMBL.

KMBL issued a Demand Notice to the borrowing entities and the Corporate Debtor under the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act 2002, followed by a Possession Notice after it claimed that the borrower entities failed to make payments as per the compromise and due to default in payment by the Corporate Debtor of the amount demanded. KMBL further issued a Winding Up Notice dated 6th May 2008 under sections 433 and 434 of the Companies Act, 1956 to the Corporate Debtor.

KMBL further filed 3 applications before the Debt Recovery Tribunal (DRT) for issuance of Debt Recovery Certificates in terms of the said compromise entered into between the parties. Separate Recovery Certificates dated 7th June, 2017 and 20th October, 2017 came to be issued against each of the borrower entities and the Corporate Debtor. On the basis of recovery certificates, KMBL, claiming to be a financial creditor, filed an application under Section 7 of IBC, before the learned National Company Law Tribunal (NCLT) and sought initiation of Corporate Insolvency Resolution Process (CIRP) against the Corporate Debtor. The NCLT admitted the said application. Feeling aggrieved by this decision of the NCLT, Director of the Corporate Debtor filed an appeal against the said order of the learned NCLT before the learned National Company Law Appellate Tribunal (NCLAT).

The learned NCLAT while allowing the appeal held that the application filed by KMBL was timebarred and that issuance of a Recovery Certificate would not trigger the right to sue. Feeling aggrieved by the order of the NCLAT, the appellant-KMBL moved Supreme Court.

Senior Advocate Guru Krishna Kumar, appeared on behalf of KMBL, whereas Senior Advocate V. Prakash and S. Prabhakaran appeared on behalf of the Director of the Corporate Debtor (Respondent No.1) and Senior Advocate K.V. Viswanathan, represented M/s Prasad Properties and Investments Pvt. Ltd. (Respondent No.2).

The Supreme Court noted that a judgment is said to be per incuriam when any provision of a statute, rule or regulation is not brought to the notice of the court or if it is inconsistent with previous judgments made by co-ordinate or larger bench and held that "we do not find any inconsistency in the judgment of this Court in the case of Dena Bank (supra) with the earlier judgments of this Court on which reliance is placed by Shri Viswanathan. We find that the contention that the judgment of this Court in the case of Dena Bank (supra) being per incuriam to the statutory provisions and earlier judgments of this Court, is wholly unsustainable."

On the question of whether liability in respect of a claim arising out of a Recovery Certificate would be included within the meaning of the term "financial debt"- the court noted "in clause (8) of Section 5 of the IBC, i.e, the definition clause of the term "financial debt", the words used are "means a debt along with interest, if any, which is disbursed against the consideration for the time value of money and includes"- After referring various judgments the court held that the effect of using the word "includes" would be to enlarge the scope of the statute and further held that Legislature has only given instances, which could be included in the term "financial debt". However, the list is not exhaustive but inclusive.

The Supreme Court after considering the relevant provisions of the IBC afresh held "a liability in respect of a claim arising out of a Recovery Certificate would be a "financial debt" within the meaning of clause (8) of Section 5 of the IBC and a holder of the Recovery Certificate would be a "financial creditor" within the meaning of clause (7) of Section 5 of the IBC."

"a person would be entitled to initiate CIRP within a period of three years from the date on which the Recovery Certificate is issued." the court held further.

Accordingly, the Court allowed the appeal filed by KMBL and set aside the order of NCLAT.

Click here to read/download the Judgment