'NSEL' A Financial Establishment – SC Upholds Attachment Of Properties Of 63 Moon Technologies (Read Judgment)

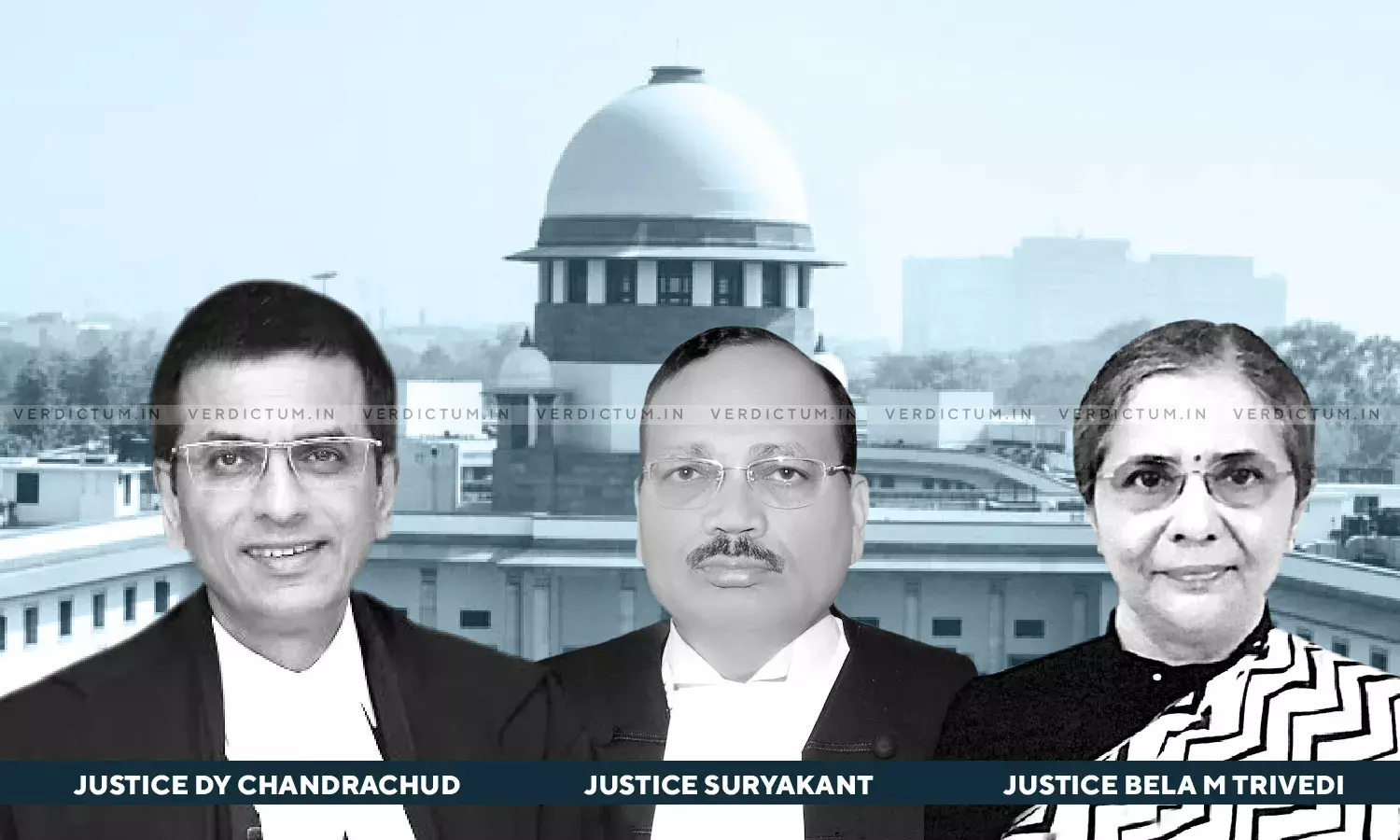

A three-judge Bench of Justice DY Chandrachud, Justice Suryakant, and Justice Bela M. Trivedi has held that National Spot Exchange Ltd. (NSEL) a full owned subsidiary of 63 Moon Technologies is a financial establishment under the Maharashtra Protection of Interest of Depositors (in Financial Establishments) Act, 1999 (MPID).

The Court set aside the Bombay High Court's order of freeing the attachment of the properties of 63 Moon Technologies and upheld the notifications issued under Section 4 of MPID whereby the properties of NSEL were attached.

Senior Counsel Mr. Jayant Mehta appeared for the Appellant, ASG Mr. Vikramjit Banerjee appeared for the State of Maharashtra, Senior Counsel Mr. Abhishek Manu Singhvi appeared for the Respondent along with Senior Counsel Mr. Mukul Rohatgi before the Apex Court.

On 5th June 2007, the Union of India issued a notification under Section 27 of the Forward Contracts (Regulation) Act, 1952 exempting forward contracts of one-day duration for sale and purchase of commodities traded on NSEL from the application of the provisions of the Act.

NSEL started operating as an exchange for spot trading in commodities and also offered trading in paired contracts in the form of T + 2 and T + 25 duration. A show-cause notice came to be issued on 27th April 2012 by the Department of Consumer Affairs (DCA) on why action against NSEL should not be taken for permitting transactions in violation of exemption notification.

In July 2013, about 13,000 persons who traded on the NSEL platform claimed that other trading members had defaulted on the payment of approximately Rs. 5,600 Crores. Thereafter, NSEL issued a circular stating that it had suspended its spot exchange operations and that delivery of all pending contracts would be merged and contracts would be settled after the expiry of 15 days. The Government then withdrew its exemption notification.

The Union of India ordered an inspection of accounts of NSEL and 63 Moons under Section 209A of the Companies Act. The Economic Offences Wing (EOW) also registered cases against the directors and key management personnel of NSEL and 63 Moons and against trading members and brokers of NSEL under the IPC and MPID Act.

NSEL preferred a Writ Petition challenging the invocation of the MPID Act on the ground that the exchange was not a financial establishment under the Act. The petition was dismissed by the Division Bench of the High Court on a number of grounds.

The State of Maharashtra then issued a notification under Section 4 of the MPID Act to attach the properties of the 63 Moons.

The Apex Court on 26th October 2016 dismissed as withdrawn the SLP filed against the order of the Bombay High Court.

The Appellants then filed a Writ Petition before the Bombay High Court challenging the notification issued under Section 4 of MPID Act attaching the properties of Respondent. The validity was challenged contending that they are violative of Articles 14, 19, and 300-A of the Constitution.

Further notifications were issued by the State of Maharashtra under Sections 4 and 5 of the MPID Act for attaching the properties of the Respondent to recover the defaulted money. The petition came to be allowed by the High Court.

The issue which was dealt with by the Court was –

Whether NSEL is a 'financial establishment' under Section 2(d) of the MPID Act.

- Definition of Financial Establishment and Deposits under the MIPD Act

The Apex Court referred to Section2(d) of the MPID Act which reads as –

"Financial Establishment" means any person accepting deposit under any scheme or arrangement or in any other manner but does not include a corporation or a co-operative society owned or controlled by any State Government or the Central Government or a banking company as defined under clause (c) of section 5 of the Banking Regulation Act, 1949."

The Bench then referred to Section 2(c) of the MPID Act which defines the expression 'deposits' as –

"i) Any receipt of money or the acceptance of a valuable commodity by a financial establishment; (ii) Such acceptance ought to be subject to the money or commodity being required to be returned after a specified period or otherwise; and (iii) The return of the money or commodity may be in cash, kind or in the form of a specified service, with or without any benefit in the form of interest, bonus, profit or in any other form."

The Bench also noted that the repeated use of 'any' by the statute while defining both the above expressions is a clear reflection of the legislative intent to cast the net of the regulatory provisions of the law in a broad and comprehensive manner.

- Whether NSEL received deposits as per Section 2(d) of the MPID Act

The Bench in this context noted that NSEL received both money and commodities from trading members. Hence, in order to decide if these receipts could be treated as deposits, the test of return would have to be satisfied.

The Court further in this regard, held, "…if the financial establishment is obligated to return the deposit without any increments, it shall still fall within the purview of Section 2(c) of the MPID Act, provided that the deposit does not fall within any of the exceptions."

The Bench also held, "The exception of relevance to our case is clause (v) which states that amounts received in the ordinary course of business by way of (a) security deposit; (b) dealership deposit; (c) earnest money; and (d) advance against order for goods or services shall be excluded from the purview of the term deposit.'

- Settlement Guarantee Fund under Section 2(c) of the MPID Act

The Court noted that the payment of margin deposit and security deposit is mandatory for a person to trade on NSEL's platform, and Settlement Guarantee Fund (SGF) refers to security deposit as per Regulations.

The Bench added that merely because the SGF is referred to as a Security deposit the exception would not be automatically applied.

The Court held that since NSEL received the money in the form of SGF that is returned in money and services, and is not covered by the exceptions, it would fall within the expression 'deposit' under Section 2(c) of the MPID Act.

The Bench went head to hold that though NSEL was receiving deposits, it failed to provide services as promised against the deposits and failed to return the deposits on demand. Therefore, the State of Maharashtra was justified in issuing the attachment notifications under Section 4 of the MPID Act.

- Constitutional Validity of MPID Act

The Bench noted that the Respondents had challenged the constitutional validity of the provisions of the MPID Act before the High Court arguing that it was arbitrary, however, the High Court did not deal with it and left the matter open.

The Court placed reliance on two precedents namely; State of Maharashtra v. Vijay C. Puljal and Sonal Hemant Joshi v. State of Maharashtra where the Apex Court had upheld the constitutional validity of the MPID Act.

In this context, the Bench observed –

"Having discussed the judgments of this Court on the constitutional validity of the state legislations governing financial establishments offering deposit schemes, including the MPID Act, there is no reason for us to reopen the question. This Court has held that the MPID Act is constitutionally valid on the grounds of legislative competence and when tested against the provisions of Part III of the Constitution."

In the light of these observations, the Court allowed the appeals and set aside the impugned order of the High Court. The Court held that the impugned notifications issued under Section 4 of the MPID act are valid.

Click here to read/download the Judgment