Chhattisgarh Land Revenue Code| Nominal Transaction For Benefit Of Non-Tribal Wouldn't Fall Exclusively Within Jurisdiction Of Authorities: SC

The Supreme Court in an appeal held that as per Section 257 of the Chhattisgarh Land Revenue Code, 1959, a nominal transaction for the benefit of a non-tribal may not fall exclusively within the jurisdiction of the Revenue Authorities.

The Court refused to interfere with the concurrent judgment and decrees of the three Courts below.

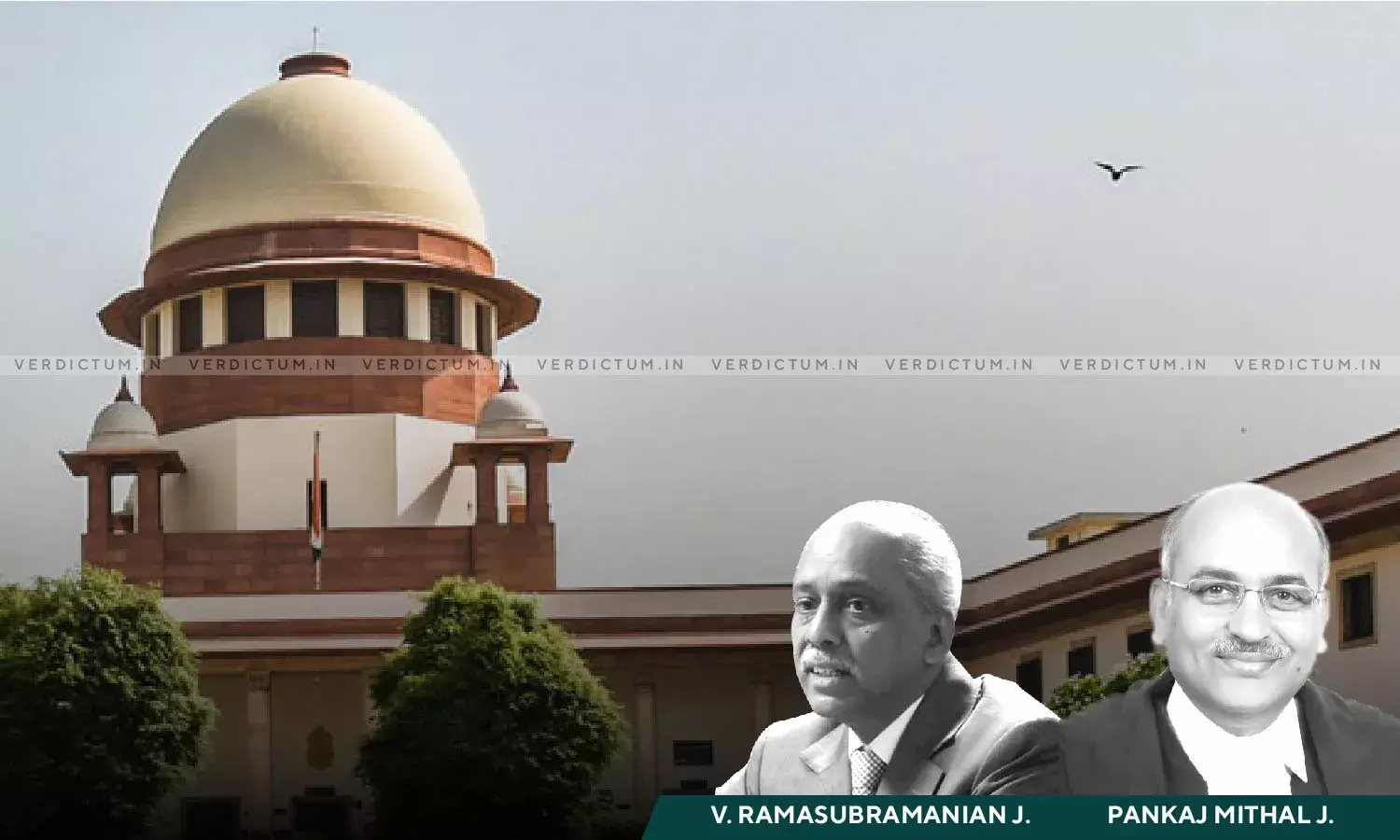

The two-Judge Bench comprising Justice V. Ramasubramanian and Justice Pankaj Mithal said, “As rightly pointed out by the High Court, the bar of jurisdiction under Section 257 of the Code relates to any matter which the Authorities are empowered to determine/decide or dispose of. The question whether the purchase by a tribal was a sham and nominal transaction for the benefit of a non-tribal, may not fall exclusively within the jurisdiction of the Authorities. Therefore, the High Court was right in rejecting the said contention.”

The appellants in this matter had challenged the judgment and decree passed by the Chhattisgarh High Court, Trial Court and the First Appellate Court.

Advocate Taruna Singh Gohil appeared on behalf of the appellants while Senior Advocate Rajesh Pandey represented the respondents.

In this case, the respondent filed a suit for declaration of title and permanent injunction in respect of a land purchased by him under a deed of sale. He purchased the said land from one seller and that seller belonged to the Scheduled Tribe. Though the respondent himself belonged to a Scheduled Tribe, the appellants contended that the purchase was on behalf of his master who was not a Tribal and that the purchase was actually a benami transaction for the benefit of a non-tribal.

The Trial Court rejected the stand taken by the appellants and decreed the suit and the decree came to be confirmed both by the First Appellate Court and the High Court. The main issues before the Apex Court were: (i) the question of validity of the sale was already decided in the proceedings before the Revenue Authorities and hence operated as res judicata; and (ii) there was a clear bar of jurisdiction of the civil court, under Section 257 of the Chhattisgarh Land Revenue Code.

The Supreme Court while considering the above issues noted, “… the power conferred by Section 165(6c) is to be exercised while passing an order under sub-section (6a), granting or refusing to grant permission or under sub-section (6b), ratifying or refusing to ratify the transaction. Such a power is not expressly extended to avoidance of transfers under Section 170.”

The Court also noted that the question as to whether the respondent was only the ostensible owner and not the beneficial owner could not have been gone into by the Revenue Authorities.

“An attempt was made by the appellants herein to show that the transaction was hit by Benami Transaction (Prohibition) Act, 1988. That was also rejected by the Trial Court. Since all these questions could not have been gone into by the Revenue Authorities, the findings recorded by them could not have operated as res-judicata”, observed the Court.

The Court asserted that when the transferee himself was a tribal person and he himself had come to Court seeking a declaration that his purchase was genuine and valid, the Court is certainly entitled to hold an enquiry.

Accordingly, the Apex Court dismissed the appeal.

Cause Title- Khora (Dead) Through Legal Heirs & Ors. v. Mohar Sai & Ors.

Click here to read/download the Judgment