When Sale Deed Is Presented For Registration Authority Must Ascertain Its Correct Market Value: SC Observes

The Supreme Court while sending back a case to Assistant Stamp Collector has asserted that when a sale deed is presented for registration, the registering authority must ascertain the correct market value of the property on the date of execution of the document.

The Court noted that the stamp duty is payable on the basis of such market value and not on the consideration mentioned in the document, and that if the consideration mentioned is more than the market value, the stamp duty will be payable on the consideration shown.

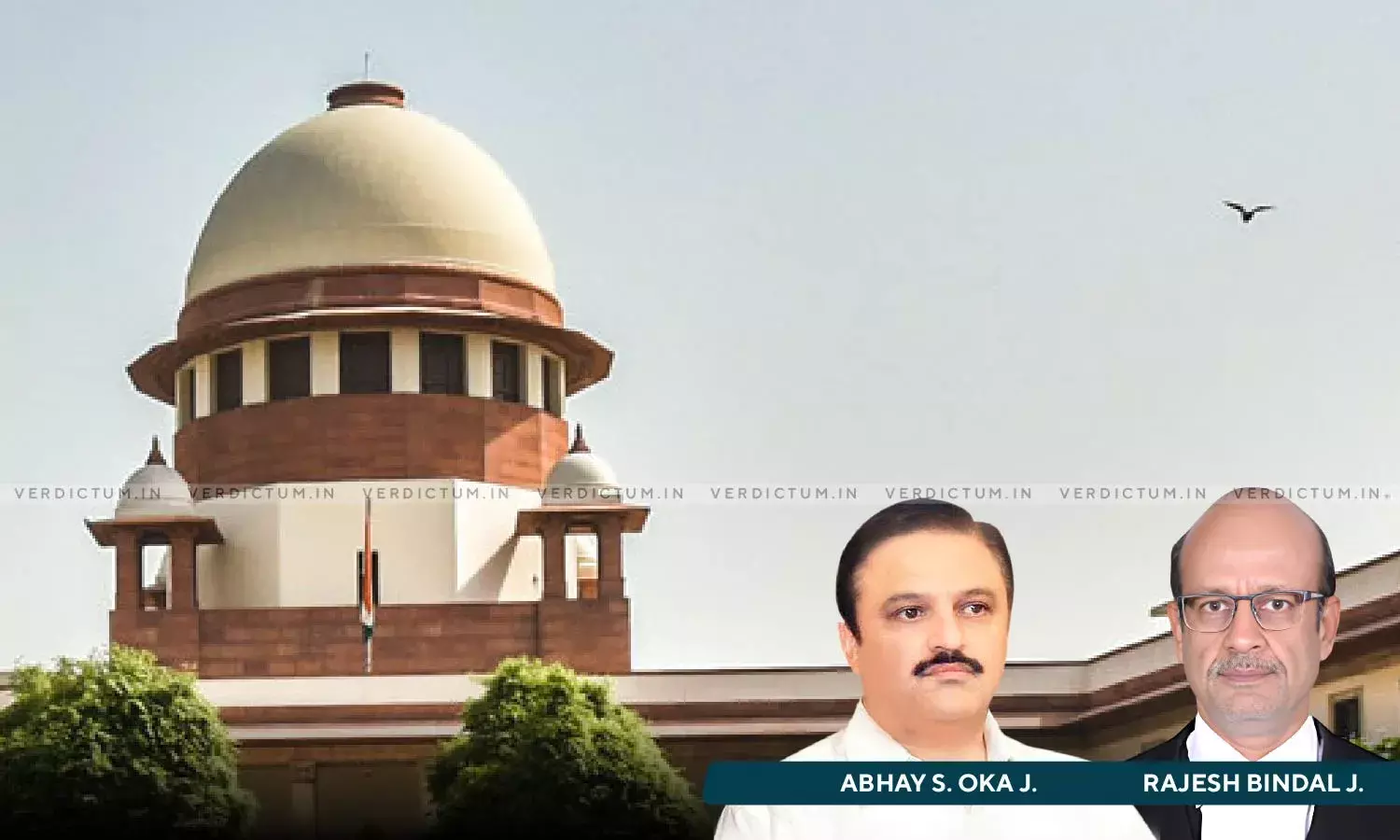

The two-Judge Bench comprising Justice Abhay S. Oka and Justice Rajesh Bindal held, “… when a sale deed is presented for registration, the registering authority must ascertain the correct market value of the property subject matter of the document on the date of execution of the document. The stamp duty is payable on the basis of such market value and not on the consideration mentioned in the document. If the consideration mentioned is more than the market value, the stamp duty will be payable on the consideration shown. Moreover, the market value mentioned in the agreement for sale or the market value prevailing on the date of the agreement or the market value prevailing on the date on which the bargain was struck is of no relevance for deciding the stamp duty. The relevant market value is the one which prevails on the date of execution of the conveyance.”

The Bench further said that the appellants were under an obligation to pay the stamp duty calculated on the market value of the sale deed property on the date of execution of the sale deed.

Senior Advocate Jayant Bhushan appeared in person and on behalf of the other appellants while Senior Advocate R.K. Raizada appeared on behalf of the State.

Facts -

The dispute involved in the appeal was about the determination of the market value of a property at Allahabad purchased by the appellants under a registered sale deed from a vendor. In the year 1939 a bungalow together with an appurtenant land and outhouse as well as a cottage was taken on rent by the appellant’s father and the appellants claimed to be protected tenants under the United Provinces (Temporary) Control of Rent and Eviction Act, 1947 and subsequently under the U.P. Urban Buildings (Regulation of Letting, Rent and Eviction) Act 1972.

The vendor agreed to sell the sale deed property to the appellant father for a total sale consideration of Rs. 1 lakh and a sum of Rs. 5000/¬ was paid to the vendor as earnest money. The appellant filed a suit for specific performance and a compromise was arrived at between the vendor and the appellants under which the appellants agreed to give up approximately 1/3rd of the land which was a part of the original agreement for sale and then an agreement for sale was executed leading to a compromise decree passed by the Civil Court in 2010.

The Supreme Court in the above context observed, “… stamp duty was paid by the appellants by taking the market value of the sale deed property at Rs.6,67,200/-. This market value was fixed by adopting method used for levy of property tax under the Municipal laws. Such a value cannot be taken as the basis for determining the market value for the purposes of Article 23. … There is no doubt that a property in possession of a tenant or tenants will fetch lesser value in the open market than the market value of a similar property exclusively in possession of the vendor. The reason is that the buyer will not get actual possession of the portion of the property in possession of the tenant.”

The Court noted that the market value can be determined by the comparison method even in the case of a property in possession of tenants.

“The issue regarding the market value of the sale deed land on the date of execution of the sale deed is required to be decided by permitting the parties to adduce oral and documentary evidence. The Assistant Collector will have to ascertain whether a comparable sale instance of a property in possession of tenants is available. … we propose to send back the case to the Assistant Stamp Collector for determination of the market value of the sale deed land on the date of execution of the sale deed.”, said the Court.

The Court observed that the appellants have already deposited a sum of Rs.1 crore towards the amount made payable by them and that the sum amount will be subject to the final adjudication by the Assistant Stamp Collector. The Court, therefore, directed the Assistant Stamp Collector to conclude the proceedings as early as possible and preferably within a period of 6 months.

Accordingly, the Court allowed the appeal, set aside the judgments of the High Court, Assistant Stamp Collector, and Appellate Authority, and remanded the case for fresh consideration.

Cause Title- Shanti Bhushan (D) Thr. LR & Ors. v. State of U.P. & Ors.